How to minimise fringe benefits tax across your fleet, reducing costs and the complexity with electronic logbooks

Fringe benefits tax (FBT) is paid by employers on certain benefits they provide to their employees or their employees’ family or other associates. FBT applies even if the benefit is provided by a third party under an arrangement with the employer.

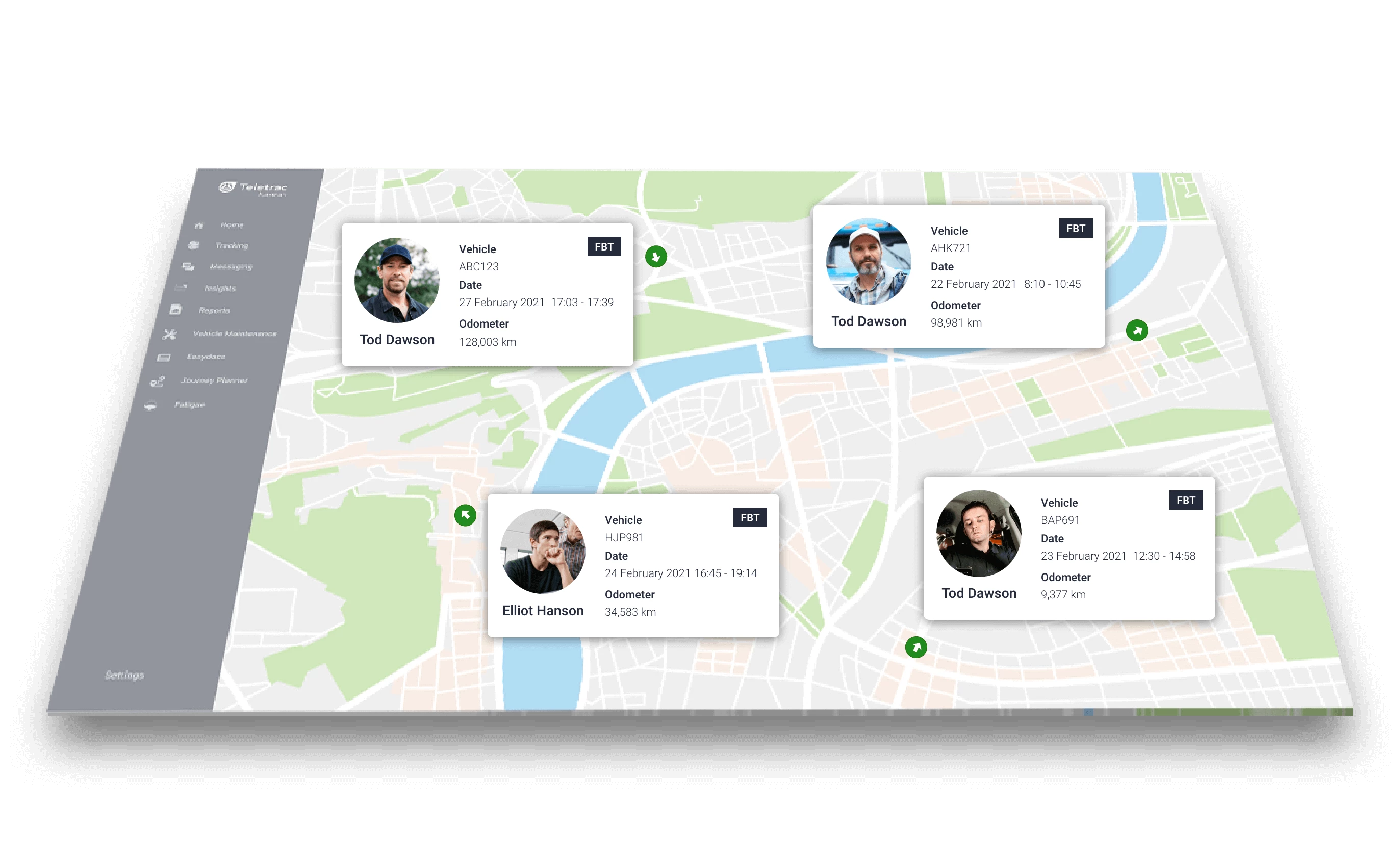

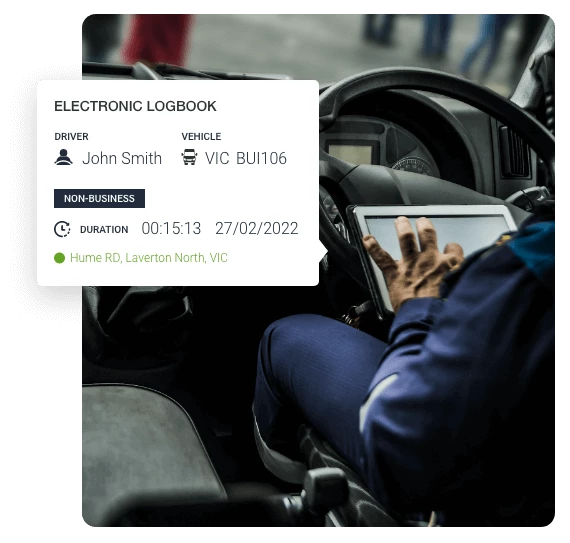

Using an electronic logbook makes it easy to collect, assess and process information to prove business and private usage. Clearly establishing maximum business use over any given three-month period minimises FBT liability.

Download the eBook Build Your Solution

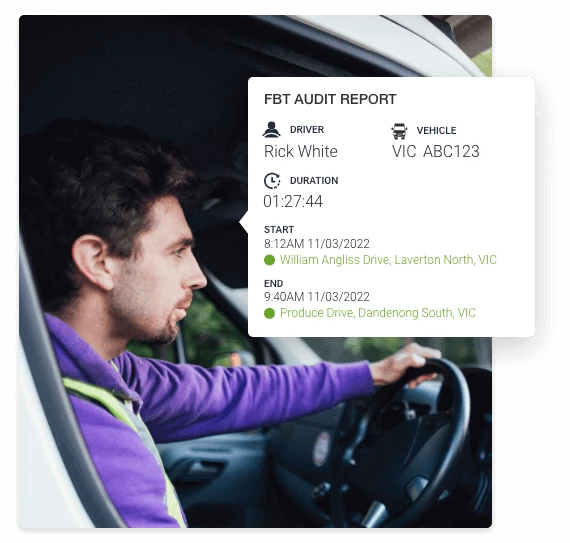

There is a general requirement that you must keep records that are adequate to enable your fringe benefits tax (FBT) liability to be assessed. Your records must be written in English or in electronic form and must be kept for five years.

Many businesses have been reluctant to use the operating cost model because manual logbooks are labour-intensive and often inaccurate. By using the Teletrac Navman electronic logbook, which has been approved by the Australian Taxation Office, it’s easy to collect the data you need to make an accurate claim.

A fleet is only as effective as its management, and your FBT return is more rewarding when that fleet is a tightly-run ship. Maximising your return means understanding vehicle use and if there are any activities that can be reduced or improved upon.

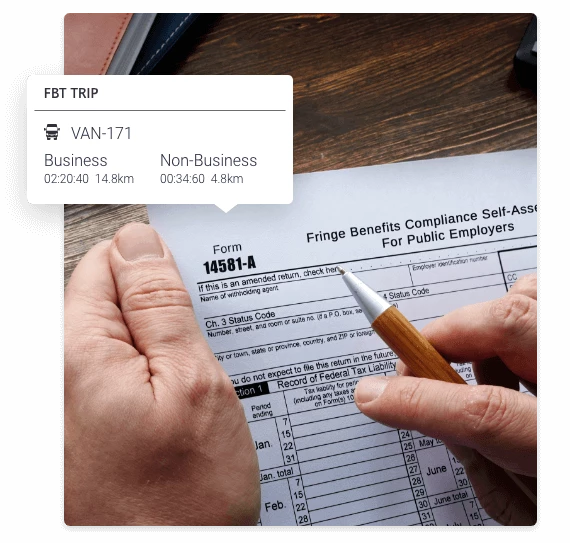

There are two ways to calculate FBT – either with the statutory formula or operating cost method. Most businesses have typically used the statutory method because it’s a straightforward way of calculating vehicle FBT and does not require the driver to keep a detailed logbook.

Keeping a manual logbook has always been an onerous task so many businesses have historically relied on statutory fraction.

In comparison, using an electronic logbook approved by the Australian Taxation Office means you can collect all relevant information from your fleet in real-time. It also enables you to share the report and easily calculate FBT based on operational costs at the push of a button, delivering significant savings.

An electronic logbook can effectively replace a paper logbook with no need to keep a hard copy of the information contained in the device unless stipulated by a specific law or regulation in your industry. This reduces the paperwork required to be completed by drivers and streamlines back-office processes.

Trying to figure out what FBT is, how it works and how it applies to you? Download our free eBook. You’ll find out about the two methods of calculating FBT, record keeping requirements, the rules, how it works, and more.

Download the Free eBookBrowse some of our articles below to help you on your journey of implementing electronic logbooks