Get the fuel tax rebate your business deserves by going Digital with your Fuel Tax Credit (FTC) management

Teletrac Navman’s FTC Manager is the most revolutionary fuel tax credit solution that uses real-time high-definition second-by-second GPS location data from telematics installed in vehicles and equipment to calculate off-road travel and auxiliary fuel use to maximise your fuel tax rebates.

Build Your Solution Get the eBook

As the first solution of its kind to receive ATO's product ruling and class ruling, it helps your business maintain compliance with strict guidelines, while providing unparalleled flexibility to suit the needs of the business. With specialty industry features, like Work Lights Conex, FTC Manager helps road construction businesses maximise their fuel tax claims, while allowing mixed fleets to measure hours of use for up to six different items of auxiliary equipment.

Whether you’re working in construction, agriculture, forestry, mining, government, or transport, FTC Manager is an entirely flexible and integrated solution built to meet the needs of those who use fuel on Australian roads.

By automating your fuel tax requirement, you can reduce administrative costs and tax risks. FTC Manager ensures you’re receiving the maximum refund entitled to reinvest back into the business while staying compliant.

In the world of fuel tax credits, you're entitled to the highest rate of fuel tax credit claim for fuel used other than for travel on a public road. This extends to fuel used in roads construction and maintenance activities even when on public roads.

Historically, we've seen that most agricultural operators correctly claim the higher off-road fuel tax credit entitlement for fuel used on their agricultural properties. However the same can't be said for transport operators that service the agriculture industry

Peter Perich, director of Fuel Tax Advisers, is often asked what makes Teletrac Navman's FTC Manager solution different to others on the market.

FTC Manager is the only solution designed to operate exclusively via HD data, or high-definition, second-by-second data acquired via Teletrac Navman's GPS devices.

So what are the common mistakes and missing opportunities when it comes to claiming fuel tax credits? Tune in to Peter Perich, director of Fuel Tax Advisers discuss the top 3 mistakes followed by the top 3 opportunities that everyone should know about.

The first GPS-based Fuel Tax Credits system in Australia to receive an ATO Product Ruling (PR 2024/18) confirming that the claim methodology is fair and reasonable

ATO Class Ruling (CR 2024/68) confirming that FTC Manager reports can be used for record-keeping

Your GPS vehicle and asset data paired with Fuel Tax Advisers' FTC advisory services

Part of Teletrac Navman’s connected and AI-enabled fleet management solution

Access to experienced FTC specialists with a proven track record

Designed to exclusively operate with real-time telematics data from vehicles and assets

No algorithms to connect the dots between timed satellite updates, just real-time waypoints

Rely on actual data from each vehicle, not average percentages across your entire fleet

Choose the level of service you require based on your business needs

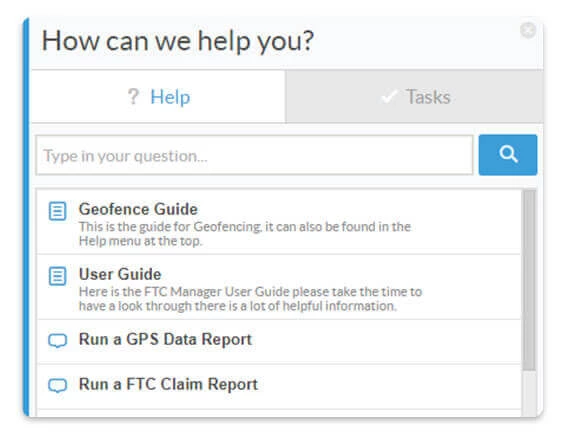

Dedicated support team, round-the-clock online training, and help through the process

Ability to outsource the entire process, letting Fuel Tax Advisers' experts take care of it all

Option for a complete 4-year retrospective fuel tax refund review, even if you’ve claimed

FTC Manager is a unique solution that exclusively uses second-by-second data from it's GPS-enabled telematics.

Download the eBook The DifferentiatorsA compact, robust GPS telematics device is fitted to your asset(s)

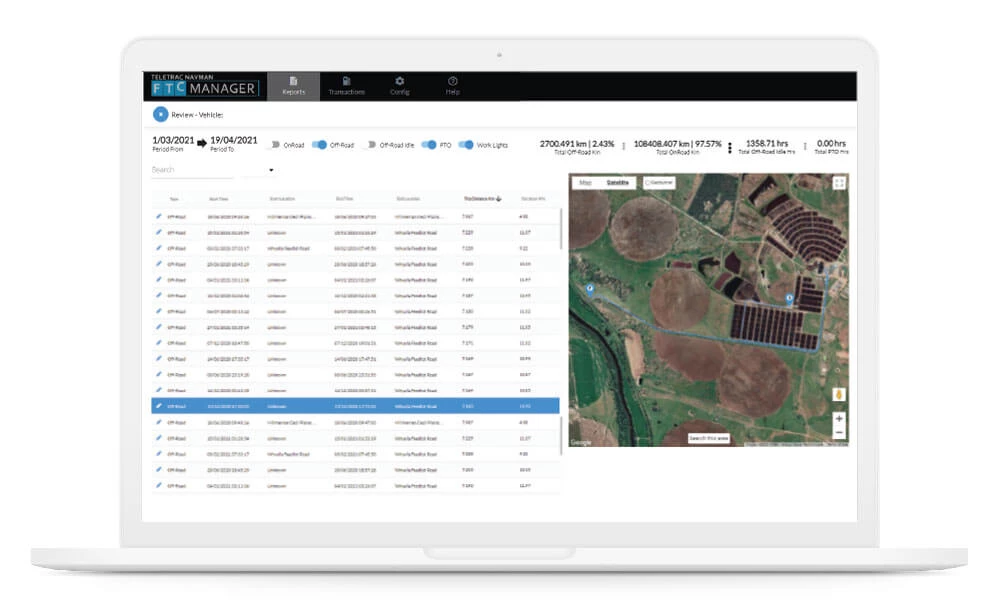

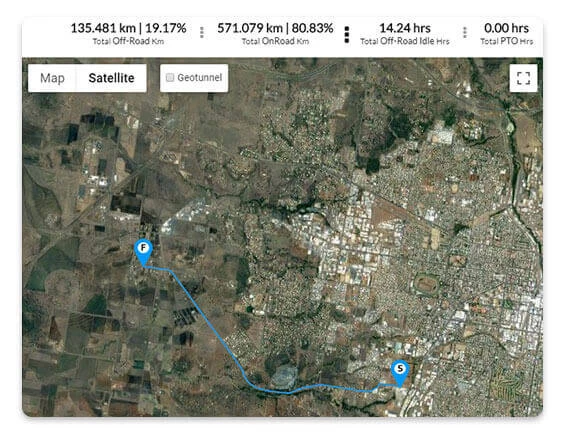

Second-by-second data is sent in real-time to FTC Manager and processed through our dual-layered mapping system

Auxiliary equipment operating data is fed into the processor for up to 6 separate items of auxiliary equipment (either directly or via PTO)

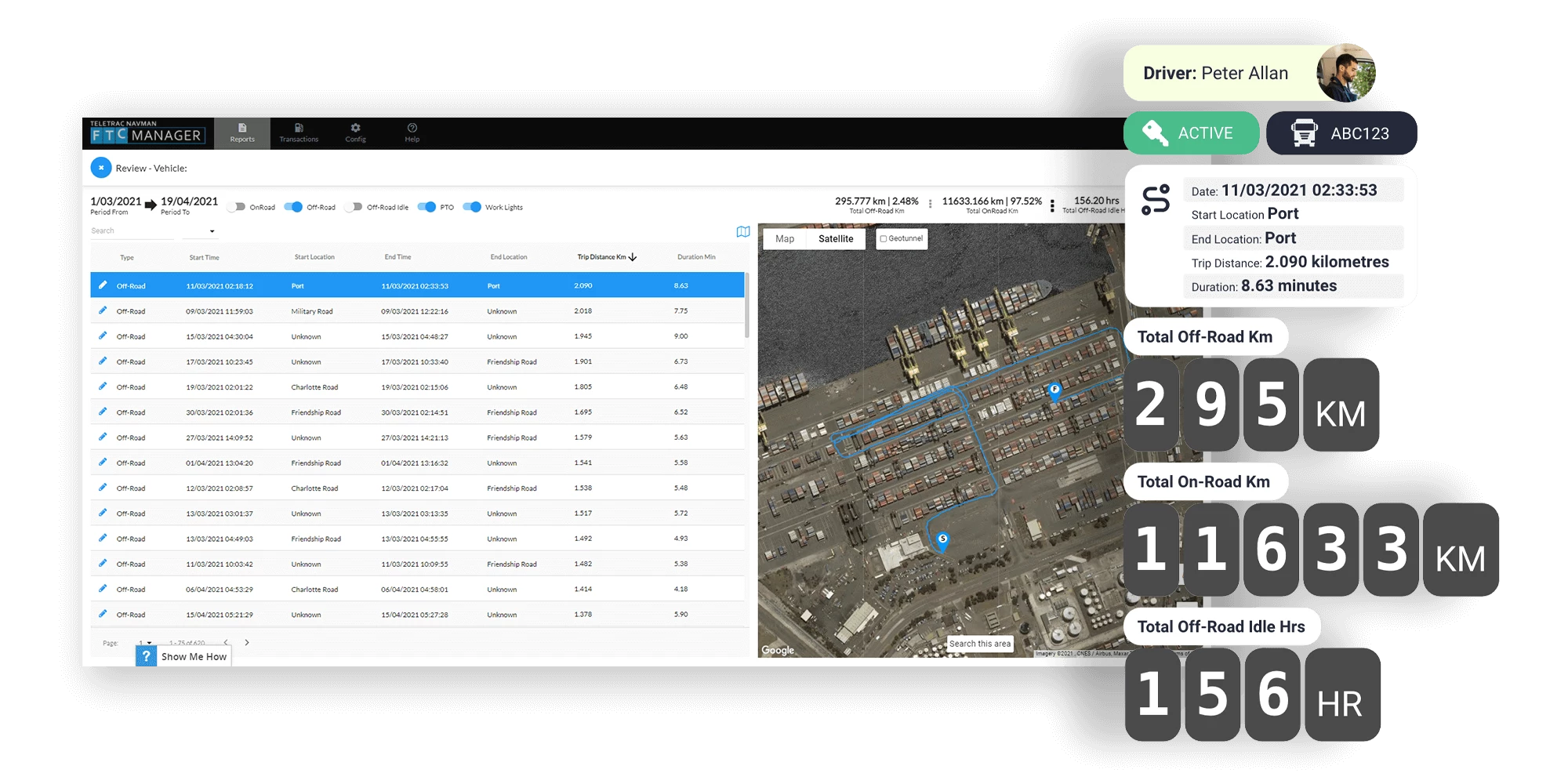

FTC Manager automatically calculates apportionment percentages and off-road operating hours for each vehicle in our GPS Data Reports

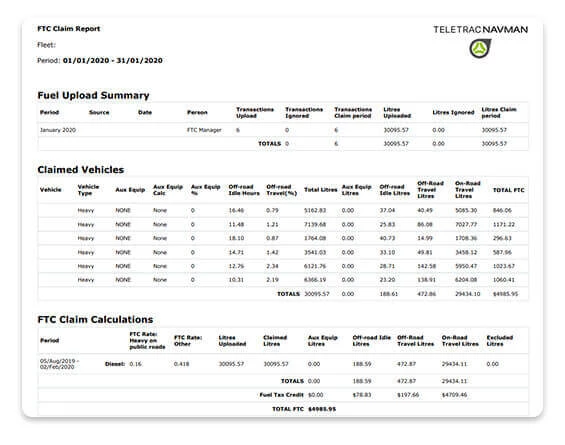

Choose to upload fuel and run FTC Claim Reports yourself or outsource your entire FTC compliance process to Fuel Tax Advisers

Receive ongoing monthly FTC rebates at optimal rates

Accurate reporting of travel, idle and auxiliary equipment operating activities for maximum ongoing rebates

Over 500 customers, more than 300 retrospective reviews – benefit from FTC Manager’s proven ATO audit success

Reduce risk of unsuccessful audits and provide total confidence in your compliance with an ATO product and class rulings

Accurate, easy-to-read reports are just a few clicks away

“We know we’re claiming exactly what we should be rather than relying on an estimation – not a cent less, and not a cent more” – Allan Every, Group Systems and Processes Manager at McGregor Gourlay

Save Money - Maximise claim value with detailed off-road and auxiliary fuel use reporting. Accurate, transparent, ongoing tax rebates. Improved rebate value potentially in the range of $15 - $250 per vehicle per month.

Save Time - Claims processing and administration made easy. Automatic fuel consumption recording and claims - calculations. Optional claims processing and retrospective rebate service for up to four years prior.

Remove Paperwork and Guesswork - Online ATO claims solution with Class Ruling compliance. Evidence-based claims provide a complete picture of claim entitlements for auditing. Reduced tax risk of penalty interest or fines.

FTC Manager helps to increase your FTC entitlements with accurate off-road trip recording and auxiliary fuel consumption reports. It continues to reduce your administration time with streamlined claim preparation, automated claims calculations and easy to use online reporting. The solution Reduces your tax risk with ATO approved Class Ruling technology, full transparency and auditability of claims. FTC Manager provides knowledge and awareness of where your vehicles are, where they have been and how they are being driven.

Partnered with Fuel Tax Advisers l to provide a unique service that supplies the data to support accurate FTC calculations. The solutions will calculate on-and-off-road travel percentages but still require significant work to convert them into actual FTC claim amounts. FTC Manager doesn’t only record off-road travel for your vehicles. It accurately captures on-road travel, off-road travel, off-road idle and auxiliary fuel use.